Introduction.

The B2B digital payments market is growing at a very fast pace due to the growing demand for effective and secure transactions. Companies are moving away from conventional payment modes to digital modes to improve operational effectiveness and curtail costs.

Market Growth and Projections.

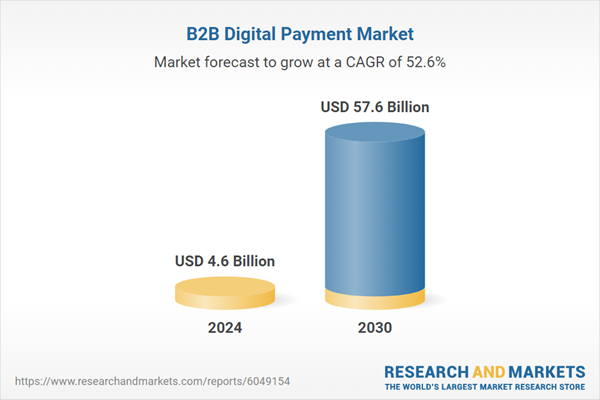

In 2024, the world B2B digital payments market size was $4.6 billion. By 2030, it is expected to reach $57.6 billion at a CAGR of 52.6%. This impressive growth reflects the surging use of digital payment solutions across industries.

Key Drivers of Market Expansion.

There are a number of reasons why this market is growing. Greater digitization of financial transactions and increased cross-border commerce require quicker, more secure means of payment. Technological advancements such as AI-based fraud prevention and blockchain increase the speed and security of electronic payments. Also, greater focus on sustainability pushes companies towards using paperless, electronic means of payment.

Impact of Cross-Border Trade.

The increase in cross-border transactions strongly increases demand for digital payments. Companies need solutions supporting several currencies and adherence to numerous regulatory requirements. Digital platforms provide speedier settlements and clear fee mechanisms, ensuring easier international transactions. Blockchain technology specifically allows safe, real-time cross-border payments with no middlemen.

Enterprises that have digital payment systems in place have several advantages. Large organizations can process multiple payment channels from centralized platforms, making supplier network complexity easier to manage. Digital payments guarantee timely, precise transactions, improving vendor relationships. Automated invoicing and reconciliation features minimize administrative burdens, and businesses can concentrate on core operations. Small and medium-sized businesses (SMEs) enjoy accessibility and scalability, making them capable of competing internationally. Integration with software such as CRM and accounting software improves operational efficiency further.

Top Market Players.

Key players spearheading this market are ACI Worldwide, Adyen, BharatPe, FIS, Fiserv, Global Payments, JUSPAY, MasterCard, PayPal, and Paystand. These entities provide various digital payment solutions designed to meet different business requirements. Their offerings include digital wallets, virtual cards, and blockchain-based solutions, enabling secure, low-cost transactions.

Conclusion.

The B2B digital payments industry is on the cusp of significant expansion, driven by technology and growing demand for convenient, secure transactions. As companies increasingly focus on digital transformation, the use of digital payment solutions will become even more central to their operations.